Categories

coins and bullion

July 13, 2025

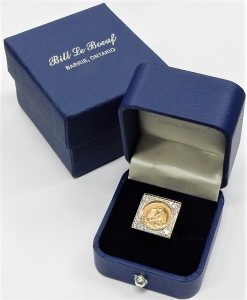

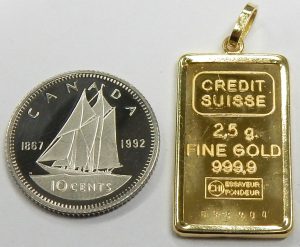

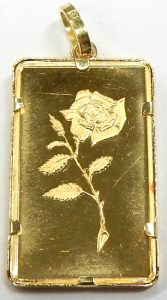

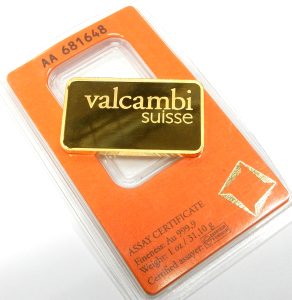

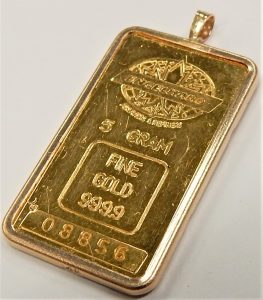

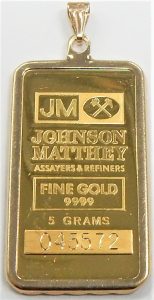

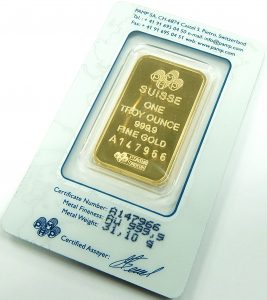

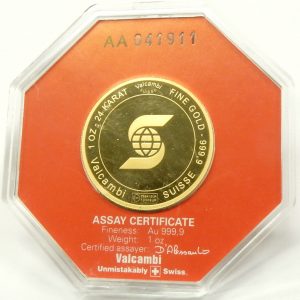

5gr. fine gold wafer (spot + 2%), 2.28gr. 18kt. frame $325.00 extra. 912-00696, 436-00349

Sometimes you can make a pretty convincing argument that jewellery can be an investment. In this case there is no doubt this pendant is a wearable investment. The majority of value in the pendant comes in the form of a pure gold wafer can be sold sales tax free. The only sales tax we need to collect is on the portion of value the 18 karat yellow gold frames represent ($325.00). The 999,9 purity wafer was made by Credit Suisse. The once giant Swiss multinational investment banking company was founded the mid 1800s and had revenues approaching 30 billion in the latter part of 2010s. They were acquired in 2023 UBS Group who manage the largest amount of private wealth in the world. It is said that they count close to half of the world’s billionaires as UBS clients.

Sometimes you can make a pretty convincing argument that jewellery can be an investment. In this case there is no doubt this pendant is a wearable investment. The majority of value in the pendant comes in the form of a pure gold wafer can be sold sales tax free. The only sales tax we need to collect is on the portion of value the 18 karat yellow gold frames represent ($325.00). The 999,9 purity wafer was made by Credit Suisse. The once giant Swiss multinational investment banking company was founded the mid 1800s and had revenues approaching 30 billion in the latter part of 2010s. They were acquired in 2023 UBS Group who manage the largest amount of private wealth in the world. It is said that they count close to half of the world’s billionaires as UBS clients.  If you ever want to sell a wafer the tabs simply be bent backward to release the bar. This method of securing the fine gold ensures it doesn’t get contaminated with solder. It also allows us to sell you the individual parts so the sales tax only needs to be collected on the frame section. At current gold level $4,585.00.00 CAD (July 11, 2025) the wafer is worth $752.00 including the 2% premium. The wafer and frame are being sold as a set only. Please add 2% for credit card purchase. Stock number 912-00696 (wafer), 436-00349 (frame).

If you ever want to sell a wafer the tabs simply be bent backward to release the bar. This method of securing the fine gold ensures it doesn’t get contaminated with solder. It also allows us to sell you the individual parts so the sales tax only needs to be collected on the frame section. At current gold level $4,585.00.00 CAD (July 11, 2025) the wafer is worth $752.00 including the 2% premium. The wafer and frame are being sold as a set only. Please add 2% for credit card purchase. Stock number 912-00696 (wafer), 436-00349 (frame).

SOLD

10 oz. 999 fine silver bar Britannia from The Royal Mint of England. Spot + 5%. 912-00716

The image of Britannia has been around for over 2000 years. She is somewhat the equivalent to the United State of America’s Lady Liberty. Both are beautiful images of strength and pride. These are arguably one of the prettiest bullion items available. This is the first example I can remember coming through our estate department. We only have the one and she is offered for just 5% over the current spot price. There is no sales tax on fine bullion. First come first serve. Stock #912-00716.

The image of Britannia has been around for over 2000 years. She is somewhat the equivalent to the United State of America’s Lady Liberty. Both are beautiful images of strength and pride. These are arguably one of the prettiest bullion items available. This is the first example I can remember coming through our estate department. We only have the one and she is offered for just 5% over the current spot price. There is no sales tax on fine bullion. First come first serve. Stock #912-00716.

SOLD

July 7, 2025

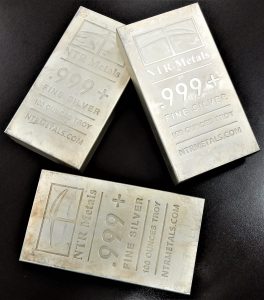

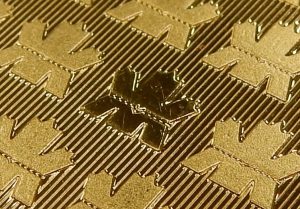

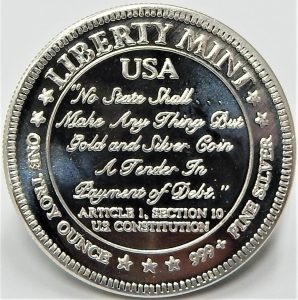

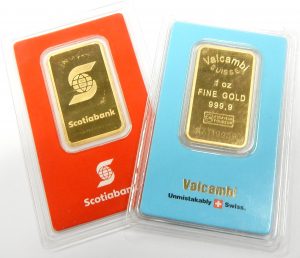

misc. 10 oz. and 1 kilo 999 or 9999 bars (spot plus 5%) no additional sales tax, no minimums.

We’re not usually sellers of silver bullion at Bill Le Boeuf Jewellers. Over the past few years we’ve sold very little but bought almost every ounce offered to us. Every once in a while we like to let go some of go. These attractive 10 ounce and 1 kilo bars are all priced at just their silver content value plus 5% with no minimum purchase requirements. Most bullion dealers require minimum purchase of 100 ounces or more to be close to this price depending on the brand. North Texas Refinery, Argentia, Asahi, Sunshine, A-Mark, GS Gold Stock, and Pamp Suisse, poured and milled bars all priced exactly the same at spot plus 7%. We may have a few other brands available in other sizes. Fine 999 and 9999 silver is very hard to find at reasonable prices and we are not always sellers of such material. Fine gold and fine silver is not applicable to any form of sales tax in Canada. The Canadian Revenue Agency deems the sale of fine bullion a financial transaction therefor not subject to Provincial or Federal sales tax. With all the turmoil happening in the world right now, everyone should turn a little extra cash into some form of precious metal. These bars are being sold the current spot price plus 5%. No sales tax added. Please add 2% to cover credit card fees if not paying by cash, debit, or e-Transfer. We may have other single and smaller multi ounce miscellaneous packages available all for sale at spot plus 5%.

We’re not usually sellers of silver bullion at Bill Le Boeuf Jewellers. Over the past few years we’ve sold very little but bought almost every ounce offered to us. Every once in a while we like to let go some of go. These attractive 10 ounce and 1 kilo bars are all priced at just their silver content value plus 5% with no minimum purchase requirements. Most bullion dealers require minimum purchase of 100 ounces or more to be close to this price depending on the brand. North Texas Refinery, Argentia, Asahi, Sunshine, A-Mark, GS Gold Stock, and Pamp Suisse, poured and milled bars all priced exactly the same at spot plus 7%. We may have a few other brands available in other sizes. Fine 999 and 9999 silver is very hard to find at reasonable prices and we are not always sellers of such material. Fine gold and fine silver is not applicable to any form of sales tax in Canada. The Canadian Revenue Agency deems the sale of fine bullion a financial transaction therefor not subject to Provincial or Federal sales tax. With all the turmoil happening in the world right now, everyone should turn a little extra cash into some form of precious metal. These bars are being sold the current spot price plus 5%. No sales tax added. Please add 2% to cover credit card fees if not paying by cash, debit, or e-Transfer. We may have other single and smaller multi ounce miscellaneous packages available all for sale at spot plus 5%. As of this posting the maple leaf coins have already been sold. The “spot” price for silver can be seen here; add 5% for a cash, debit, or e-Transfer purchase and that’s the total price. Credit card purchase subject an additional 2% fee to cover costs.

As of this posting the maple leaf coins have already been sold. The “spot” price for silver can be seen here; add 5% for a cash, debit, or e-Transfer purchase and that’s the total price. Credit card purchase subject an additional 2% fee to cover costs.

July 4, 2025

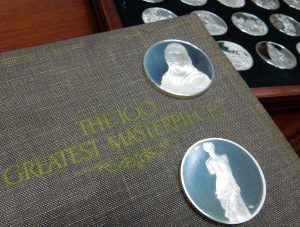

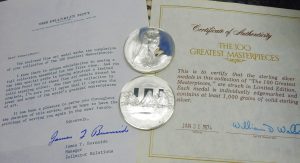

1974 Franklin Mint flags of the United Nations (4.24 kilograms sterling silver) $7,000.00 CAD. 913-00064

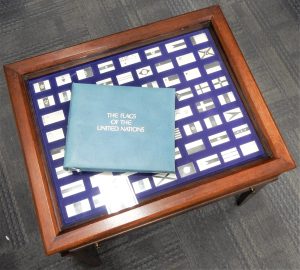

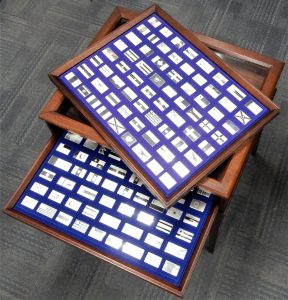

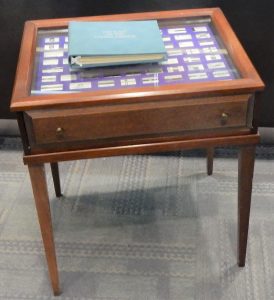

And now for something completely different. We’ve never been known for our selection of fine furniture, but this little coffee table definitely belongs among our vintage and estate treasures. This coffee table is more than worthy to be in our estate collection as it contains 136.35 troy ounces of sterling silver (over 9.3 pounds). This unusual curiosity was produced by the Franklin Mint from 1974 through 1976. The table stands a little over 2 feet tall by 22 inches wide. Contained in 2 pull-out drawers under the glass are the flags of the United Nations countries as they were in 1974.

And now for something completely different. We’ve never been known for our selection of fine furniture, but this little coffee table definitely belongs among our vintage and estate treasures. This coffee table is more than worthy to be in our estate collection as it contains 136.35 troy ounces of sterling silver (over 9.3 pounds). This unusual curiosity was produced by the Franklin Mint from 1974 through 1976. The table stands a little over 2 feet tall by 22 inches wide. Contained in 2 pull-out drawers under the glass are the flags of the United Nations countries as they were in 1974. This is a snapshot of world political history cast in high-quality 925 sterling silver ingots. A few of the 135 countries represented in this collection no longer exist today. According to the Franklin Mint website, each silver flag ingot cost $9.50 in 1974, the entire set cost $1,282.50 USD 50 years ago. These sets are quite rare as many of the 7731 produced were melted down just a few years later when the price of silver spiked from just a few dollars per ounce to almost $50.00 CAD in 1980.

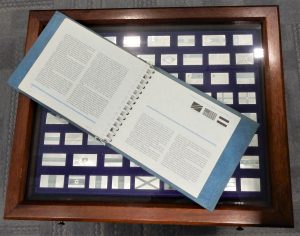

This is a snapshot of world political history cast in high-quality 925 sterling silver ingots. A few of the 135 countries represented in this collection no longer exist today. According to the Franklin Mint website, each silver flag ingot cost $9.50 in 1974, the entire set cost $1,282.50 USD 50 years ago. These sets are quite rare as many of the 7731 produced were melted down just a few years later when the price of silver spiked from just a few dollars per ounce to almost $50.00 CAD in 1980. Finding a complete set without missing components in excellent condition is almost impossible. The set comes with its original hardcover book outlining the symbolism and meanings of each country’s flag.

Finding a complete set without missing components in excellent condition is almost impossible. The set comes with its original hardcover book outlining the symbolism and meanings of each country’s flag. History collectors and those who recognize the value of silver may have an interest in this rare item. The average weight of each medallion is over one troy ounce and is 92.5% fine silver. At today’s silver price (July 4th. 2025) the recyclable silver content alone in this set is over $6,300.00 CAD. The complete collection including the table and book is estate priced at $7,000.00 CAD. Stock #913-00064.

History collectors and those who recognize the value of silver may have an interest in this rare item. The average weight of each medallion is over one troy ounce and is 92.5% fine silver. At today’s silver price (July 4th. 2025) the recyclable silver content alone in this set is over $6,300.00 CAD. The complete collection including the table and book is estate priced at $7,000.00 CAD. Stock #913-00064.

June 25, 2025

40 ounces .999 fine silver bars, Sunshine Mint. Spot plus 5%, no HST. 912-00715

Here’s your chance to start or add to your bullion collection at a price that can’t be beat. Most bullion vendors are selling fine silver like this for much more than our price. Even if you’re buying 1000s of ounces at a time, the best price we’ve seen is closer to spot plus 7% from bullion dealers. These sealed bars are from the Sunshine mint in Nevada. They are one of the larger silver refiners and supply bullion to several sovereign mints around the world. These bars are available in 2 sheets of 20 x 1 ounce examples. They are factory sealed and show zero oxidation or discolouration. We are selling them as a set of forty only. We may have other bars and coins in stock if you’re looking for a smaller amount. Pure bullion like this is not subject to sales tax of any kind, as it is considered a financial transaction. At spot plus just 5%, we expect these bars to sell very quickly. First come first serve. Offered at just the intrinsic silver value plus 5%. For credit card payment please add 2% to cover the credit card fees. To see up to the minute silver pricing, historical silver and gold charts, check out BullionVault.com. As of writing this posting (June 24, 2025) silver is priced at $49.24 CAD per ounce, making the 40 ounces worth $2,068.08 including the 5% premium. Actual purchase price will be determined at the time of sale. Stock #912-00715.

Here’s your chance to start or add to your bullion collection at a price that can’t be beat. Most bullion vendors are selling fine silver like this for much more than our price. Even if you’re buying 1000s of ounces at a time, the best price we’ve seen is closer to spot plus 7% from bullion dealers. These sealed bars are from the Sunshine mint in Nevada. They are one of the larger silver refiners and supply bullion to several sovereign mints around the world. These bars are available in 2 sheets of 20 x 1 ounce examples. They are factory sealed and show zero oxidation or discolouration. We are selling them as a set of forty only. We may have other bars and coins in stock if you’re looking for a smaller amount. Pure bullion like this is not subject to sales tax of any kind, as it is considered a financial transaction. At spot plus just 5%, we expect these bars to sell very quickly. First come first serve. Offered at just the intrinsic silver value plus 5%. For credit card payment please add 2% to cover the credit card fees. To see up to the minute silver pricing, historical silver and gold charts, check out BullionVault.com. As of writing this posting (June 24, 2025) silver is priced at $49.24 CAD per ounce, making the 40 ounces worth $2,068.08 including the 5% premium. Actual purchase price will be determined at the time of sale. Stock #912-00715.

SOLD

May 29, 2025

1945 two 1/2 Pesos coin ring 12.8gr. 14kt. 0.20ct. tw I1-IJ, sz. 7. $1,498.00 CAD. 116-00050

A gold Mexican two and a half Peso coin from the year World War II ended; incidentally, Mexico was very vocal in encouraging their southern neighbors to support the Allies after they joined the fighting in 1942. The coin has been framed with white gold and diamonds, setting off the rich warmth of its 90% gold content.

A gold Mexican two and a half Peso coin from the year World War II ended; incidentally, Mexico was very vocal in encouraging their southern neighbors to support the Allies after they joined the fighting in 1942. The coin has been framed with white gold and diamonds, setting off the rich warmth of its 90% gold content.

The 17.68mm x 17.71mm ring top features 0.20 carats total weight of I1-IJ round brilliant cut diamonds. The rest of the ring is understated 14 karat yellow gold in a finger size 7 with some room to adjust. Estate price is $1,498.00 CAD. Stock #116-00050.

The 17.68mm x 17.71mm ring top features 0.20 carats total weight of I1-IJ round brilliant cut diamonds. The rest of the ring is understated 14 karat yellow gold in a finger size 7 with some room to adjust. Estate price is $1,498.00 CAD. Stock #116-00050.

March 11, 2025

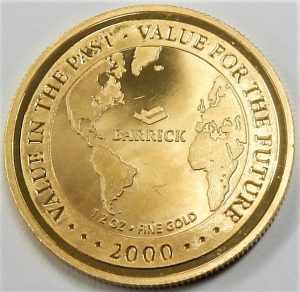

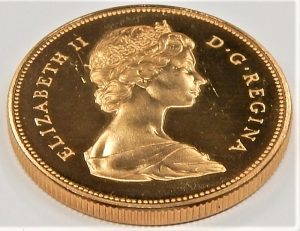

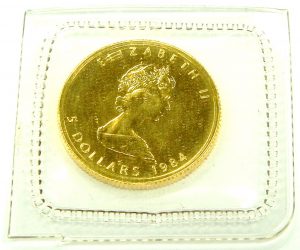

NON bullion gold coins. Spot plus zero!!!!

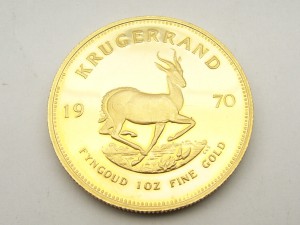

Everyone loves pure gold investment bullion. We never have enough 99.9% pure gold or silver to satisfy the requests we get for it. We also have Canadian 14 karat, 22 karat, and the occasional 1967 90% pure Canadian Centennial gold coins, plus other recognized world gold coins that are usually alloyed to 22 karat. Here are some NON bullion coins we are selling for only the intrinsic value of the gold they each contain. There is no additional markup considering numismatic value, rarity, or collectability. These coins each contain from little under 1/4 ounce to 1 full ounce of gold. The only extra charge is one we have no control over; because these coins are not 99.9% pure, they are subject sales tax. The frames on some of the coins are also priced for only the gold content they contain plus sales tax. Vintage British sovereigns, South African Krugerrands, $100.00 Canadian coins and a few others are what we currently have in stock. Everything you see here is being sold for simply the value of gold in each coin plus applicable sales tax (some have already been sold). For NON cash/debit/e-Transfer purchases please add 2% to cover credit card fees.

Everyone loves pure gold investment bullion. We never have enough 99.9% pure gold or silver to satisfy the requests we get for it. We also have Canadian 14 karat, 22 karat, and the occasional 1967 90% pure Canadian Centennial gold coins, plus other recognized world gold coins that are usually alloyed to 22 karat. Here are some NON bullion coins we are selling for only the intrinsic value of the gold they each contain. There is no additional markup considering numismatic value, rarity, or collectability. These coins each contain from little under 1/4 ounce to 1 full ounce of gold. The only extra charge is one we have no control over; because these coins are not 99.9% pure, they are subject sales tax. The frames on some of the coins are also priced for only the gold content they contain plus sales tax. Vintage British sovereigns, South African Krugerrands, $100.00 Canadian coins and a few others are what we currently have in stock. Everything you see here is being sold for simply the value of gold in each coin plus applicable sales tax (some have already been sold). For NON cash/debit/e-Transfer purchases please add 2% to cover credit card fees.

January 5, 2025

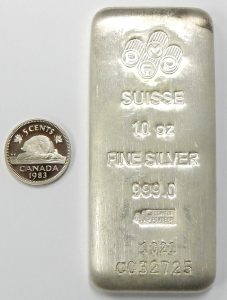

10 ounce Pamp Suisse 999 fine silver bar. Spot +5% (no sales tax). 912-00684

I’m pretty sure there are potentially better investments than purchasing 10 ounces of silver bullion, but I’m 100% positive there are many worse places to spend a little rainy day money. I’m also sure that buying this silver bar at just 5% above the actual silver price is a value few vendors will match. I can point out a few interesting facts about the cost of silver right now. If you’re reading this you likely know that gold is only around 6% off its all time high in both Canadian and U.S. dollars, but silver is still needs to appreciate 10% to match its all time high that was reached way back in 1980. Right now gold costs close to 100 times more than what silver does! Historically speaking the silver to gold ration has been all over the board from as low as 20 to 1 in 1980 to where we are now at 100 to 1. Unless you feel gold is overpriced right know, silver is very undervalued. This bar can be purchased without additional sales tax. It is available for the actual silver value plus just 5%. Stock #912-00684.

I’m pretty sure there are potentially better investments than purchasing 10 ounces of silver bullion, but I’m 100% positive there are many worse places to spend a little rainy day money. I’m also sure that buying this silver bar at just 5% above the actual silver price is a value few vendors will match. I can point out a few interesting facts about the cost of silver right now. If you’re reading this you likely know that gold is only around 6% off its all time high in both Canadian and U.S. dollars, but silver is still needs to appreciate 10% to match its all time high that was reached way back in 1980. Right now gold costs close to 100 times more than what silver does! Historically speaking the silver to gold ration has been all over the board from as low as 20 to 1 in 1980 to where we are now at 100 to 1. Unless you feel gold is overpriced right know, silver is very undervalued. This bar can be purchased without additional sales tax. It is available for the actual silver value plus just 5%. Stock #912-00684.

SOLD

January 4, 2025

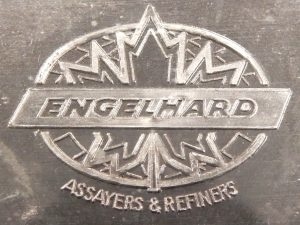

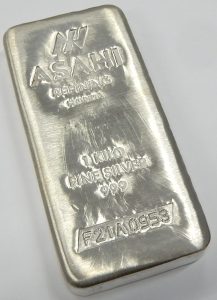

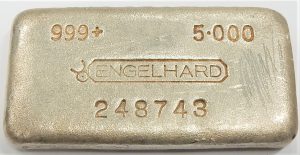

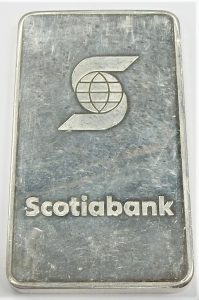

Uncommon Engelhard Canada 1 ounce 999 fine silver bar $70.00 CAD. 912-00697

From bottle caps to fine art and vintage watches, people like to collect the rare and unusual. The the world of precious metals and bullion are no exception, early and vintage silver bars command premiums over the actual precious metal value they contain. This is a scarce Engelhard Canadian 1-ounce fine silver bar. Engelhard refineries were once one of the largest, if not the largest refiner of silver, gold, and platinum in the world.

From bottle caps to fine art and vintage watches, people like to collect the rare and unusual. The the world of precious metals and bullion are no exception, early and vintage silver bars command premiums over the actual precious metal value they contain. This is a scarce Engelhard Canadian 1-ounce fine silver bar. Engelhard refineries were once one of the largest, if not the largest refiner of silver, gold, and platinum in the world. The company is also credited for producing the world’s first production automotive catalytic converter. The bull logo used on this vintage bar is a combination of ancient alchemical symbols. The circle with a dot in the centre represents the sun, and the masculine metal gold; the reversed C symbolizes the moon, and the more feminine precious metal silver.

The company is also credited for producing the world’s first production automotive catalytic converter. The bull logo used on this vintage bar is a combination of ancient alchemical symbols. The circle with a dot in the centre represents the sun, and the masculine metal gold; the reversed C symbolizes the moon, and the more feminine precious metal silver. Early alchemists combined the two believing platinum was an amalgam of gold and platinum. Engelhard used this symbol on most of their Canadian silver bar production. We don’t really consider ourselves precious metal dealers but we do see bullion and coins come in through our estate department on a regular basis. Unusual bars like this are the rare exception. This scarce Canadian 1 ounce bar is priced at $70.00 CAD and comes in its original plastic packaging. The package has been torn at one end but we don’t believe the bar has ever been removed. As this is a fine silver bullion product, it is not subject to any form of sales tax. Estate priced at $70.00 CAD. Stock #912-00697.

Early alchemists combined the two believing platinum was an amalgam of gold and platinum. Engelhard used this symbol on most of their Canadian silver bar production. We don’t really consider ourselves precious metal dealers but we do see bullion and coins come in through our estate department on a regular basis. Unusual bars like this are the rare exception. This scarce Canadian 1 ounce bar is priced at $70.00 CAD and comes in its original plastic packaging. The package has been torn at one end but we don’t believe the bar has ever been removed. As this is a fine silver bullion product, it is not subject to any form of sales tax. Estate priced at $70.00 CAD. Stock #912-00697.

SOLD

January 3, 2025

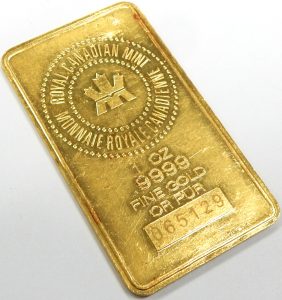

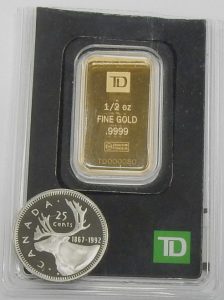

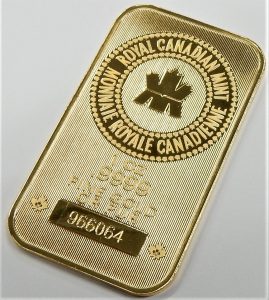

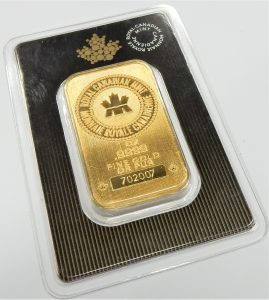

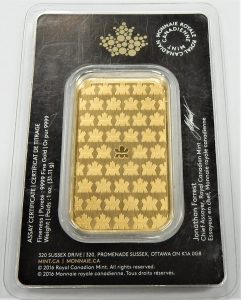

1 ounce Royal Canadian Mint fine gold bar, spot plus 2% (no sales tax). 912-00669

Most people consider the price of gold relative to a dollar. A of today (May 6th, 2025) an ounce of gold is worth around $4,700.00 Canadian dollars. Comparing gold to currency is likely an inaccurate measure of what gold is really worth. Currency is continually becoming less valuable because inflation continuously diminishes its buying power. The value of gold should be compared to what it can buy. What we mean but this is how much gold does it take to buy the things you need. That could be a car, a whole lot of groceries, or even a house. Here is something to consider. We all know how expensive a house costs nowadays. A decent starter house in Barrie costs around $700,000.00 today or the equivalent of cost to 150 ounces of gold. 25 years ago that same house cost around $300.00 ounces of gold. House prices have shot up around 500% in 25 years but gold has appreciated close to 1000%. Amazing as it seems, gold would have been a much better investment than real estate. An interesting automotive comparison would be this; a Corvette cost around 140 ounces of gold 25 years ago, today a Corvette costs the same as just 21 ounces of gold. Yes gold has been the place to park some extra cash over the last few decades. Where the price of gold is heading is hard to say for sure but the trend is still very positive for gold.

Most people consider the price of gold relative to a dollar. A of today (May 6th, 2025) an ounce of gold is worth around $4,700.00 Canadian dollars. Comparing gold to currency is likely an inaccurate measure of what gold is really worth. Currency is continually becoming less valuable because inflation continuously diminishes its buying power. The value of gold should be compared to what it can buy. What we mean but this is how much gold does it take to buy the things you need. That could be a car, a whole lot of groceries, or even a house. Here is something to consider. We all know how expensive a house costs nowadays. A decent starter house in Barrie costs around $700,000.00 today or the equivalent of cost to 150 ounces of gold. 25 years ago that same house cost around $300.00 ounces of gold. House prices have shot up around 500% in 25 years but gold has appreciated close to 1000%. Amazing as it seems, gold would have been a much better investment than real estate. An interesting automotive comparison would be this; a Corvette cost around 140 ounces of gold 25 years ago, today a Corvette costs the same as just 21 ounces of gold. Yes gold has been the place to park some extra cash over the last few decades. Where the price of gold is heading is hard to say for sure but the trend is still very positive for gold. Our latest estate bullion offering is this Royal Canadian Mint 1 ounce pure gold bar. It is 99.99% pure, this type of purity is amount the finest that is commercially available. Occasionally the Royal Canadian Mint produce some coins that are 99.999% pure. Gold bullion is exempt from sales tax in Canada. The price fluctuates every day relative to the dollar. A great source for the current gold spot price is BullionVault.com. We are offering this 1 ounce bar for only 2% over the spot price. Owning a little gold can be considered insurance to protect you against the effects of inflation on your cash. We are not big dealers of precious metals although it comes and goes with regularity. If you’d like a little gold bullion this is a great one to start with, RCM products are among the most sought after and trusted in the world. For VISA/MasterCard purchases please add an additional 2% to cover credit card fees. Stock #912-00669.

Our latest estate bullion offering is this Royal Canadian Mint 1 ounce pure gold bar. It is 99.99% pure, this type of purity is amount the finest that is commercially available. Occasionally the Royal Canadian Mint produce some coins that are 99.999% pure. Gold bullion is exempt from sales tax in Canada. The price fluctuates every day relative to the dollar. A great source for the current gold spot price is BullionVault.com. We are offering this 1 ounce bar for only 2% over the spot price. Owning a little gold can be considered insurance to protect you against the effects of inflation on your cash. We are not big dealers of precious metals although it comes and goes with regularity. If you’d like a little gold bullion this is a great one to start with, RCM products are among the most sought after and trusted in the world. For VISA/MasterCard purchases please add an additional 2% to cover credit card fees. Stock #912-00669.

SOLD

January 2, 2025

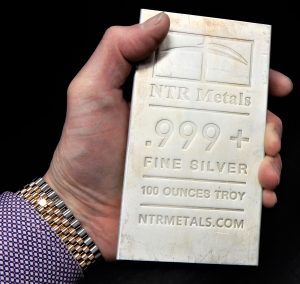

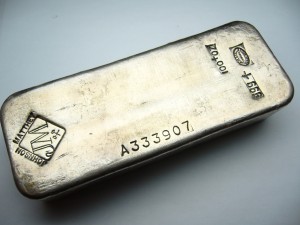

3 x 100 oz. fine silver bars North Texas Refinery. Spot plus 5% (NO SALES TAX). 912-00677

Silver bullion is so inexpensive right now. 1 ounce of silver is more than 88 times less expensive than 1 ounce of gold. The historic relationship of gold vs. silver price is closer to 40 to 1. There have only been 2 other times in history that I’m aware of when the silver/gold ratio has been more distorted than right now. This tells us that gold is overpriced or that silver is under priced. With all the chaos in the world at the moment my personal belief is both silver and gold are under valued but much more so in the case of silver. With silver pricing as low as it has been for the last few years we’ve slowly been acquiring silver but seldom (almost never) do we sell any of it. For all those people who call us asking for silver bullion here’s your chance. These 100 ounce bars of 999 fine silver were manufactured by North Texas Refinery.

Silver bullion is so inexpensive right now. 1 ounce of silver is more than 88 times less expensive than 1 ounce of gold. The historic relationship of gold vs. silver price is closer to 40 to 1. There have only been 2 other times in history that I’m aware of when the silver/gold ratio has been more distorted than right now. This tells us that gold is overpriced or that silver is under priced. With all the chaos in the world at the moment my personal belief is both silver and gold are under valued but much more so in the case of silver. With silver pricing as low as it has been for the last few years we’ve slowly been acquiring silver but seldom (almost never) do we sell any of it. For all those people who call us asking for silver bullion here’s your chance. These 100 ounce bars of 999 fine silver were manufactured by North Texas Refinery. The bars measure around 14cm x 7cm x 3cm but are surprisingly hefty when you hold it in your hand. Each weight just a little under 7 pounds. There is no sales tax on precious metals; Revenue Canada looks upon these sales as financial transactions therefore not subject to any form of sales tax. Everyone should own some bullion as security against the effects inflation has on your cash. These 3 are the only 100 ounce bars we are selling at the moment. Priced at just spot plus 5% currently around $5,010.00 CAD (credit card purchases please add 2% service fee). First come first serve. Contact us immediately if you’re interested. You almost never see fine silver bullion price a such a low premium over spot, usually it is close to 10% above the spot price or more depending on the brand and form. Stock #912-00677.

The bars measure around 14cm x 7cm x 3cm but are surprisingly hefty when you hold it in your hand. Each weight just a little under 7 pounds. There is no sales tax on precious metals; Revenue Canada looks upon these sales as financial transactions therefore not subject to any form of sales tax. Everyone should own some bullion as security against the effects inflation has on your cash. These 3 are the only 100 ounce bars we are selling at the moment. Priced at just spot plus 5% currently around $5,010.00 CAD (credit card purchases please add 2% service fee). First come first serve. Contact us immediately if you’re interested. You almost never see fine silver bullion price a such a low premium over spot, usually it is close to 10% above the spot price or more depending on the brand and form. Stock #912-00677.

SOLD

January 1, 2025

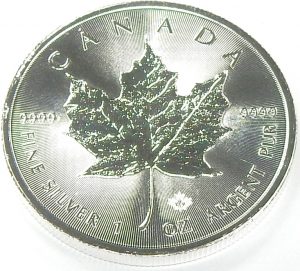

16 x 1oz. 9999 Canadian maple leaf coins, miscellaneous years, spot plus 10% (set only). 912-00672

Ready made starter set of fine silver (99.99% purity) Royal Canadian mint maple leaf coins. We get more requests for maple leaf coins than any other variety of silver bullion. Most times we have none in stock and we don’t keep a file of those looking for them. So when they become available don’t think about it for too long. They are always sold on a first come first serve basis. This random grouping of years is a little more interesting because you get 6 different years in the collection with 2 different portraits of the queen a special commemorative fireworks privy mark on the year 2000 coin.

Ready made starter set of fine silver (99.99% purity) Royal Canadian mint maple leaf coins. We get more requests for maple leaf coins than any other variety of silver bullion. Most times we have none in stock and we don’t keep a file of those looking for them. So when they become available don’t think about it for too long. They are always sold on a first come first serve basis. This random grouping of years is a little more interesting because you get 6 different years in the collection with 2 different portraits of the queen a special commemorative fireworks privy mark on the year 2000 coin. Most of the coins appear to be in untouched condition, still in their original plastic packaging. The first Royal Canadian silver maple leaf coins were issued in 1988 and continue to this day. They are into the 4th generation of portraits and the reverse side of these coins always features the iconic image of a maple leaf.

Most of the coins appear to be in untouched condition, still in their original plastic packaging. The first Royal Canadian silver maple leaf coins were issued in 1988 and continue to this day. They are into the 4th generation of portraits and the reverse side of these coins always features the iconic image of a maple leaf. Enhanced security features made their way into production in 2014. The standard issues mintage for these coins have been as low as just over 100,000 struck in 1997 to approaching 30 million examples in 2014. In our collection there are a couple uncommon years 2000 & 2001 with mintages of only around 400,000 each. These coins are sold without any sales tax added. They are considered a financial transaction exempt from sales tax. These are a great way to get you feet wet in silver bullion investing while at the same time getting some no charge extra value from the collector aspect of Canadian maple leaf 1 ounce coins.

Enhanced security features made their way into production in 2014. The standard issues mintage for these coins have been as low as just over 100,000 struck in 1997 to approaching 30 million examples in 2014. In our collection there are a couple uncommon years 2000 & 2001 with mintages of only around 400,000 each. These coins are sold without any sales tax added. They are considered a financial transaction exempt from sales tax. These are a great way to get you feet wet in silver bullion investing while at the same time getting some no charge extra value from the collector aspect of Canadian maple leaf 1 ounce coins. The price for silver has been on the rise for many years but still hasn’t touched its all time high of around $58.00 Canadian in 1980. This set of 9999 fine silver coins is being sold as a set of 16 only for just their value in silver plus 10%. If you’re interested in this set please contact us ASAP as these will sell quickly. The price for these coins changes every minute with the silver markets. At current silver pricing (Feb. 25th, 2025) the set will cost you around $805.00 CAD. Stock #912-00672.

The price for silver has been on the rise for many years but still hasn’t touched its all time high of around $58.00 Canadian in 1980. This set of 9999 fine silver coins is being sold as a set of 16 only for just their value in silver plus 10%. If you’re interested in this set please contact us ASAP as these will sell quickly. The price for these coins changes every minute with the silver markets. At current silver pricing (Feb. 25th, 2025) the set will cost you around $805.00 CAD. Stock #912-00672.

SOLD

December 24, 2024

2 x 1/20th oz. .999 Chinese Panda fine gold coins (spot + 2%) 912-00664

Most “gold coins” are alloyed with other metals making them more durable and long lasting once they get into general circulation. That’s makes sense in principle but when was the last time you saw a gold coin in circulation with regular currency? Truth is, since the advent of paper money, gold coins never go into circulation for face value. With the price of gold around $4,100.00 CAD per ounce, the face value of gold coins can be close to 100 times less than than their gold content. Any gold coin alloyed with other metals making them less than 99.9% pure are subject to sales tax when purchased in Canada. 99.9% pure gold coins like these Chinese pandas are seldom encountered by us. They are usually traded among collectors and purchased as investments. Only a handful of countries produce coins of such purity and these coins never go into general circulation for their face value. Bullion coins like these can legally be purchased in Canada tax free, no sales tax is added to the price. The Canada revenue agency looks upon the sale of fine gold and other precious metals as a financial transaction therefor not subject to sales tax. These 2 coins are being as pair only.

Most “gold coins” are alloyed with other metals making them more durable and long lasting once they get into general circulation. That’s makes sense in principle but when was the last time you saw a gold coin in circulation with regular currency? Truth is, since the advent of paper money, gold coins never go into circulation for face value. With the price of gold around $4,100.00 CAD per ounce, the face value of gold coins can be close to 100 times less than than their gold content. Any gold coin alloyed with other metals making them less than 99.9% pure are subject to sales tax when purchased in Canada. 99.9% pure gold coins like these Chinese pandas are seldom encountered by us. They are usually traded among collectors and purchased as investments. Only a handful of countries produce coins of such purity and these coins never go into general circulation for their face value. Bullion coins like these can legally be purchased in Canada tax free, no sales tax is added to the price. The Canada revenue agency looks upon the sale of fine gold and other precious metals as a financial transaction therefor not subject to sales tax. These 2 coins are being as pair only. They are for sale for only the intrinsic value of the gold they contain plus 2%. They are heavily handled with scuffs, scratches, dings, and dents. You can bang them up but they’ll always be worth their weight in gold no matter the condition, as long as they each weigh 1/20th of an ounce (1.555 grams). These don’t come in very often and never in significant quantities. At current gold pricing of approximately $4,100.00 per ounce Canadian these coins are selling for $410.00 for the pair plus 2%. They are very cute, each with a depiction of the lovable panda. For credit card purchases please add an additional 2% service fee. Estate priced at gold value only plus 2%. Stock #912-00664.

They are for sale for only the intrinsic value of the gold they contain plus 2%. They are heavily handled with scuffs, scratches, dings, and dents. You can bang them up but they’ll always be worth their weight in gold no matter the condition, as long as they each weigh 1/20th of an ounce (1.555 grams). These don’t come in very often and never in significant quantities. At current gold pricing of approximately $4,100.00 per ounce Canadian these coins are selling for $410.00 for the pair plus 2%. They are very cute, each with a depiction of the lovable panda. For credit card purchases please add an additional 2% service fee. Estate priced at gold value only plus 2%. Stock #912-00664.

SOLD

December 16, 2024

1.79 grams of raw placier gold (0.0575oz.) $235.00 CAD. 913-00056

Placier gold is what comes to mind when you picture an old timer prospector panning in a mountain river or stream. This is the sort of gold that has broken away from its original source and been transported over time by erosion and swift flowing water. Often these oatmeal shaped nuggets travel a good distance downstream. They are pummeled by rocks and gravel on their journey giving them these classic shapes. They eventually settle in nooks and crevasses until the relentless affects of erosion send them downriver again. We seen this sort of nugget gold before come in from the actual prospectors who found them. Judging from the vintage glass bottle, with carboard seal, and what we believe to be a bakelite lid, these nuggets were likely placed inside sometime around the 1940s.

Placier gold is what comes to mind when you picture an old timer prospector panning in a mountain river or stream. This is the sort of gold that has broken away from its original source and been transported over time by erosion and swift flowing water. Often these oatmeal shaped nuggets travel a good distance downstream. They are pummeled by rocks and gravel on their journey giving them these classic shapes. They eventually settle in nooks and crevasses until the relentless affects of erosion send them downriver again. We seen this sort of nugget gold before come in from the actual prospectors who found them. Judging from the vintage glass bottle, with carboard seal, and what we believe to be a bakelite lid, these nuggets were likely placed inside sometime around the 1940s. Placier nuggets like these usually contain around 95% pure gold with small amount silver, copper, and trace amounts of other metals. These curiosities can be used in their natural form as decoration on rings, pendants and other jewellery. We’ve decided to leave them as they were sold to us. They make an interesting conversation item for someone who is interested in precious metals. The 14 nuggets weight 1.79 grams or 0.0575 troy ounces. At today’s price for pure gold of $4,106 CAD (Feb. 5, 2024) this small amount of gold contains $225.00 in gold value. Sure we could simply refine these nuggets with other jewellery not longer suitable for use, but we’d like to leave them original for someone to make into a custom jewellery item, or just keep them in the vial. They are many millions of years old and beautiful natural objects. Bottle and gold are estate priced at $235.00 CAD. Stock #913-00056.

Placier nuggets like these usually contain around 95% pure gold with small amount silver, copper, and trace amounts of other metals. These curiosities can be used in their natural form as decoration on rings, pendants and other jewellery. We’ve decided to leave them as they were sold to us. They make an interesting conversation item for someone who is interested in precious metals. The 14 nuggets weight 1.79 grams or 0.0575 troy ounces. At today’s price for pure gold of $4,106 CAD (Feb. 5, 2024) this small amount of gold contains $225.00 in gold value. Sure we could simply refine these nuggets with other jewellery not longer suitable for use, but we’d like to leave them original for someone to make into a custom jewellery item, or just keep them in the vial. They are many millions of years old and beautiful natural objects. Bottle and gold are estate priced at $235.00 CAD. Stock #913-00056.

SOLD

November 22, 2024

1/2 ounce 99.99 Kirkland Lake Covid-19 vaccination gold button. Spot+5%. 912-00644

If you’re into gold bullion and like a good tale, this is the perfect item for you. The story goes when Covid-19 threatened to close down the Kirkland Lake gold operations, management rewarded employees with one of these 1/2 ounce 99.99 gold buttons when they showed proof of Covid-19 vaccination. Not a bad deal for the employees, especially now that gold is trading over $3,700.00 CAD, up from $2,500.00 per ounce in mid 2020. We really know nothing else about this usual gold button. We’ve only ever had one other like it pass through our store. A quick Google search found another example described as vaccination gold too, so there must by something to the story. Kirkland Lake gold merged with Agnico Eagle Mines mines in February 2022 making this just a little more collectible. Its compact dimensions of around 15.5mm x 5.3mm make it feel especially heavy. We weighed it on our scale at 15.592 grams, just over 1 troy ounce (0.50129oz.). We didn’t do a bunch of research into why it has been stamped ABC on the top, but would love to know more about it or what it means.

If you’re into gold bullion and like a good tale, this is the perfect item for you. The story goes when Covid-19 threatened to close down the Kirkland Lake gold operations, management rewarded employees with one of these 1/2 ounce 99.99 gold buttons when they showed proof of Covid-19 vaccination. Not a bad deal for the employees, especially now that gold is trading over $3,700.00 CAD, up from $2,500.00 per ounce in mid 2020. We really know nothing else about this usual gold button. We’ve only ever had one other like it pass through our store. A quick Google search found another example described as vaccination gold too, so there must by something to the story. Kirkland Lake gold merged with Agnico Eagle Mines mines in February 2022 making this just a little more collectible. Its compact dimensions of around 15.5mm x 5.3mm make it feel especially heavy. We weighed it on our scale at 15.592 grams, just over 1 troy ounce (0.50129oz.). We didn’t do a bunch of research into why it has been stamped ABC on the top, but would love to know more about it or what it means. It comes in a Kirkland Lake Gold black drawstring pouch. Being gold bullion of 99.99% purity, it is not subject to any form of sales tax. We are offering it for sale for only 5% over the gold content. For the current spot price of gold in U.S. or Canadian dollars click on Bullionvault.com. Stock #912-00644.

It comes in a Kirkland Lake Gold black drawstring pouch. Being gold bullion of 99.99% purity, it is not subject to any form of sales tax. We are offering it for sale for only 5% over the gold content. For the current spot price of gold in U.S. or Canadian dollars click on Bullionvault.com. Stock #912-00644.

SOLD

November 11, 2024

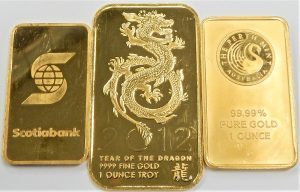

3.13gr. (0.1006oz.) 99.99 fine gold Canadian coin, “Year of the Dragon”, spot+5%. 912-00655.

2012 Year of the Dragon commemorative 99.99% pure gold coin. The Canadian coin has a face value of just $5.00, but it currently contains around $385.00 in pure gold. It was minted in a larger run of 38,888 examples. It remains in untouched condition still in its protective plastic container. Noticeably smaller than a Canadian dime but 50% heavier.

2012 Year of the Dragon commemorative 99.99% pure gold coin. The Canadian coin has a face value of just $5.00, but it currently contains around $385.00 in pure gold. It was minted in a larger run of 38,888 examples. It remains in untouched condition still in its protective plastic container. Noticeably smaller than a Canadian dime but 50% heavier. As part of the 12 year cycle, 2024 is also The Year of the Dragon according to the Chinese zodiac. This coin is made from 99.99% pure gold and therefor not subject to federal or provincial sales tax. It is for sale for just the gold value is contains plus 5% (please add an additional 2% for credit card purchase). We only have the 1, if you’re interested, contact us immediately. This one shouldn’t last around here very long. Stock #912-00655.

As part of the 12 year cycle, 2024 is also The Year of the Dragon according to the Chinese zodiac. This coin is made from 99.99% pure gold and therefor not subject to federal or provincial sales tax. It is for sale for just the gold value is contains plus 5% (please add an additional 2% for credit card purchase). We only have the 1, if you’re interested, contact us immediately. This one shouldn’t last around here very long. Stock #912-00655.

SOLD

November 7, 2024

0.496oz. 99.99 fine gold Canadian $200.00 coin “The Vikings” only 3000 minted. Spot+5%. 912-00654

Does anyone know why The Royal Canadian Mint makes commemorative coins in unusual weights like this one. The RCM have the ability to produce the world’s most pure gold coins of up to 99.999% purity, buy they chose to make this coin just shy of half an ounce. It would have only taken 0.122 grams more to be a logical 1/2 ounce. The coin itself is one of the more rare mintages with only 3000 specimens being struck. It has a face value of $200.00 and is legal tender in Canada. In 2012 when this coin was produced it contained around $850.00 worth of gold, today the value has increased to $1,840.00!!! The coin commemorates early Viking exploration to the shores of North America (Eastern Canada) believed to be around the late 10th century, close to 500 years before Columbus bumped into America. This coin is in perfect untouched condition, still in its protective plastic container. It is a little larger in diameter than a Canadian quarter and much heavier.

Does anyone know why The Royal Canadian Mint makes commemorative coins in unusual weights like this one. The RCM have the ability to produce the world’s most pure gold coins of up to 99.999% purity, buy they chose to make this coin just shy of half an ounce. It would have only taken 0.122 grams more to be a logical 1/2 ounce. The coin itself is one of the more rare mintages with only 3000 specimens being struck. It has a face value of $200.00 and is legal tender in Canada. In 2012 when this coin was produced it contained around $850.00 worth of gold, today the value has increased to $1,840.00!!! The coin commemorates early Viking exploration to the shores of North America (Eastern Canada) believed to be around the late 10th century, close to 500 years before Columbus bumped into America. This coin is in perfect untouched condition, still in its protective plastic container. It is a little larger in diameter than a Canadian quarter and much heavier. It comes with its original certificate and information document. When are you going to jump into the precious metal market? This coin is both a great piece of recognized gold bullion and a rare numismatic collectable. A great place to check the up to the second gold/silver price in both Canadian and U.S. dollars in The Bullion Vault. This coin is offered at just the gold value it contains plus 5%. Being bullion grade of 99.99% purity it is not subject to any form of sales tax. For credit card purchases please add an addition 2%. Stock #912-00654.

It comes with its original certificate and information document. When are you going to jump into the precious metal market? This coin is both a great piece of recognized gold bullion and a rare numismatic collectable. A great place to check the up to the second gold/silver price in both Canadian and U.S. dollars in The Bullion Vault. This coin is offered at just the gold value it contains plus 5%. Being bullion grade of 99.99% purity it is not subject to any form of sales tax. For credit card purchases please add an addition 2%. Stock #912-00654.

SOLD

November 1, 2024

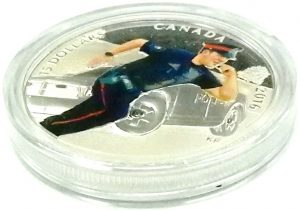

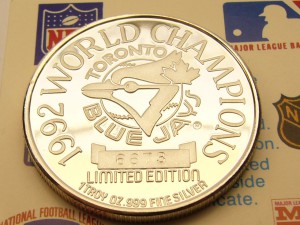

10oz. .999 fine silver Baseball/Hockey/Maple Leaf/Sunshine mint, mixed lot (spot+5%) no sales tax. 912-00648

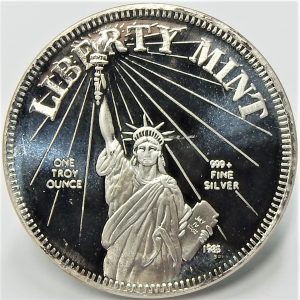

This mixed lot of .999 fine silver bullion is definitely MLB baseball biased, but there is also an NHL hockey medallion, a Royal Canadian Mint 2016 maple leaf $5.00 coin, and a U.S. Sunshine mint bar. Whether you’re a Major League Baseball fan or not, this is a great collection of silver bullion at a price that can’t be beat. If you’ve read this far you know that silver is finally starting to move, but still trails the advances gold has had over the past couple of decades. Silver is 81 times less expensive than gold right now, but many feel this gap will shrink as people look for the higher potential appreciation possible with silver. The 8 round medallions are in perfect sealed condition in protective plastic containers. There are 5 certificates that describe the mintage numbers with a copyright date of 1991. This lot is offered at only 5% over their silver content value. Fine bullion like this is not subject to sales tax. Sold as a 10 ounce collection only. First come first served. If you want them please email to info@BillLeBoeufJewellers.com or give us a call 705 728 3343. We don’t expect these to last. For credit card purchases please add 2%. Stock #912-00648.

This mixed lot of .999 fine silver bullion is definitely MLB baseball biased, but there is also an NHL hockey medallion, a Royal Canadian Mint 2016 maple leaf $5.00 coin, and a U.S. Sunshine mint bar. Whether you’re a Major League Baseball fan or not, this is a great collection of silver bullion at a price that can’t be beat. If you’ve read this far you know that silver is finally starting to move, but still trails the advances gold has had over the past couple of decades. Silver is 81 times less expensive than gold right now, but many feel this gap will shrink as people look for the higher potential appreciation possible with silver. The 8 round medallions are in perfect sealed condition in protective plastic containers. There are 5 certificates that describe the mintage numbers with a copyright date of 1991. This lot is offered at only 5% over their silver content value. Fine bullion like this is not subject to sales tax. Sold as a 10 ounce collection only. First come first served. If you want them please email to info@BillLeBoeufJewellers.com or give us a call 705 728 3343. We don’t expect these to last. For credit card purchases please add 2%. Stock #912-00648.

SOLD

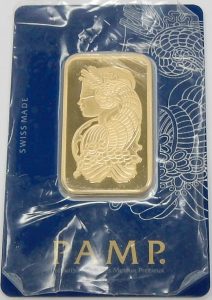

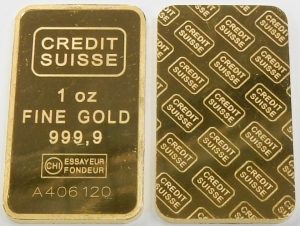

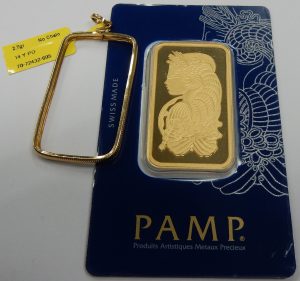

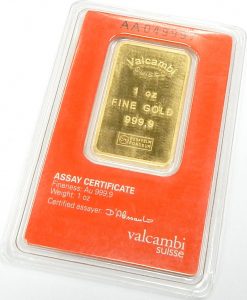

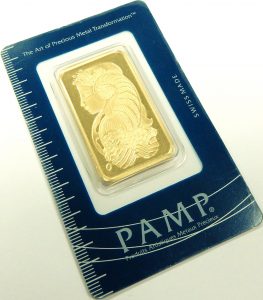

1 ounce 999.9 fine gold PAMP SUISSE Lady Fortuna bar. Spot+3%. 912-00651

In the 45 years since PAMP Suisse has been around they have grown from a small supplier of precious metals to jewellers and watch manufactures, to producing private market bullion, and suppling several international governments with currency backed bullion coins. PAMP (Produits Artistiques Métaux Précieux) Suisse bullion is recognized world wide and is among the most sought after. While not quite as common as Royal Canadian Mint products around here, it isn’t rare for us to have some PAMP Suisse bullion in stock. This PAMP bar depicts Lady Fortuna on the reverse side on the bar. From the PAMP website; “PAMP was the first precious metals brand to ever decorate the reverse sides of its minted bars. Introduced in 1979, the Lady Fortuna™ was the first of those artistic motifs and is today world-renowned as a trusted symbol assuring PAMP quality and authenticity. Undoubtedly, the iconic Lady Fortuna™ image is the most recognized and prestigious bullion bar design in the world. The Roman goddess of prosperity is portrayed with all of her mythical attributes: sheaves of wheat, poppies, horn of plenty, precious coins, and wheel of fortune.” This bar is in perfect condition without the slightest scuff or blemish.

In the 45 years since PAMP Suisse has been around they have grown from a small supplier of precious metals to jewellers and watch manufactures, to producing private market bullion, and suppling several international governments with currency backed bullion coins. PAMP (Produits Artistiques Métaux Précieux) Suisse bullion is recognized world wide and is among the most sought after. While not quite as common as Royal Canadian Mint products around here, it isn’t rare for us to have some PAMP Suisse bullion in stock. This PAMP bar depicts Lady Fortuna on the reverse side on the bar. From the PAMP website; “PAMP was the first precious metals brand to ever decorate the reverse sides of its minted bars. Introduced in 1979, the Lady Fortuna™ was the first of those artistic motifs and is today world-renowned as a trusted symbol assuring PAMP quality and authenticity. Undoubtedly, the iconic Lady Fortuna™ image is the most recognized and prestigious bullion bar design in the world. The Roman goddess of prosperity is portrayed with all of her mythical attributes: sheaves of wheat, poppies, horn of plenty, precious coins, and wheel of fortune.” This bar is in perfect condition without the slightest scuff or blemish. Our photos were taken through the protective plastic that may show some blemishes from handling. In refined form such as this 999.9 gold bar, precious metal is not subject to any form of sales tax. The cost of this bar fluctuates with the price of gold. We are selling this bar for only its intrinsic value plus 3%. The current value of gold changes every minute and can be seen in Canadian dollars here. If you are planning to purchase with a credit card, please add 2% to cover the extra costs associated with accepting VISA or MasterCard (we do not accept American Express). Pamp Suisse 1 ounce Lady Fortuna 999.9 gold bar, priced at spot plus 3% (no sales tax). 912-00651.

Our photos were taken through the protective plastic that may show some blemishes from handling. In refined form such as this 999.9 gold bar, precious metal is not subject to any form of sales tax. The cost of this bar fluctuates with the price of gold. We are selling this bar for only its intrinsic value plus 3%. The current value of gold changes every minute and can be seen in Canadian dollars here. If you are planning to purchase with a credit card, please add 2% to cover the extra costs associated with accepting VISA or MasterCard (we do not accept American Express). Pamp Suisse 1 ounce Lady Fortuna 999.9 gold bar, priced at spot plus 3% (no sales tax). 912-00651.

SOLD

October 26, 2024

6oz. Buffalo round fine silver 999 medallions. Spot + 5% (no sales tax). 912-00650

For those of you who have been calling and emailing us for silver bullion here is your chance. We seldom have physical silver bullion available for delivery and we are not alone. Obtaining actual gold and silver bullion in person is becoming more difficult all the time and those who have it make the rules. Generic silver bullion is trading hands right now for generous premiums over spot price no matter the brand or condition. We are usually not sellers of silver but occasionally we like to offer our clients the opportunity to purchase some when it becomes available through our estate department. We are offering these .999 fine silver Golden State Mint medallions at spot price plus just 5%. The major bullion traders are selling round medallions like this for 10 to 15% over spot (CAD). Even when buying single large 100-ounce bars the spot premiums are close to or over 10%. Bullion is not our main business, so we are happy to pass along a slightly smaller premium compared to the typical metal trading companies. If you have been looking for silver bullion you know how hard it is to find and a good price. This is your chance to pick some up for a little better price than the typical sources. They are being sold on a first come first serve basis. To see the current spot price for silver in Canadian dollars click here. For credit card purchases, please add 2%. We may have a few more odd bars, coins, and medallions for sale; if you’re interested please ask. Stock #912-00650.

For those of you who have been calling and emailing us for silver bullion here is your chance. We seldom have physical silver bullion available for delivery and we are not alone. Obtaining actual gold and silver bullion in person is becoming more difficult all the time and those who have it make the rules. Generic silver bullion is trading hands right now for generous premiums over spot price no matter the brand or condition. We are usually not sellers of silver but occasionally we like to offer our clients the opportunity to purchase some when it becomes available through our estate department. We are offering these .999 fine silver Golden State Mint medallions at spot price plus just 5%. The major bullion traders are selling round medallions like this for 10 to 15% over spot (CAD). Even when buying single large 100-ounce bars the spot premiums are close to or over 10%. Bullion is not our main business, so we are happy to pass along a slightly smaller premium compared to the typical metal trading companies. If you have been looking for silver bullion you know how hard it is to find and a good price. This is your chance to pick some up for a little better price than the typical sources. They are being sold on a first come first serve basis. To see the current spot price for silver in Canadian dollars click here. For credit card purchases, please add 2%. We may have a few more odd bars, coins, and medallions for sale; if you’re interested please ask. Stock #912-00650.

SOLD

October 24, 2024

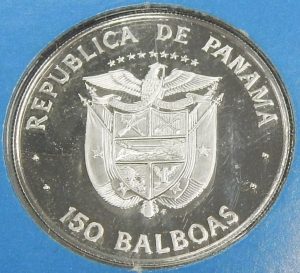

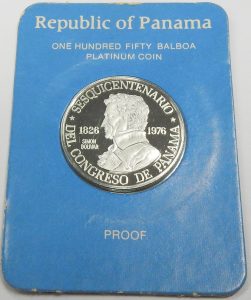

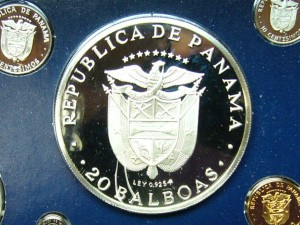

150th anniversary Panama congress 150 Balboa 999 platinum coin 0.299oz. Spot+10% (no tax). 912-00647

We see fine gold and silver bullion pretty much everyday here, but 999 platinum is scarce to say the least. We can only remember seeing fine platinum a few times pass through our estate department over the last 30 years. This is a somewhat rare (mintage of 13,000) 1976 Panama 15o Balboa platinum coin. They were manufactured by the Franklin Mint in the U.S.A. and are legal tender in Panama. At current exchange rates 150 Balboa is equal to $207.00 CAD.

We see fine gold and silver bullion pretty much everyday here, but 999 platinum is scarce to say the least. We can only remember seeing fine platinum a few times pass through our estate department over the last 30 years. This is a somewhat rare (mintage of 13,000) 1976 Panama 15o Balboa platinum coin. They were manufactured by the Franklin Mint in the U.S.A. and are legal tender in Panama. At current exchange rates 150 Balboa is equal to $207.00 CAD. The coin commemorates the 150th anniversary of the Congress of Panama. Platinum is a unique and rare metal that historically was always worth more than gold. In the early 2000s it was twice as valuable as gold. Over the past 25 years its price has hardly changed and but the price of gold has skyrocketed and is getting close to 3 times the value of platinum. This coin is in untouched condition and of proof quality, still in its protective plastic packaging.

The coin commemorates the 150th anniversary of the Congress of Panama. Platinum is a unique and rare metal that historically was always worth more than gold. In the early 2000s it was twice as valuable as gold. Over the past 25 years its price has hardly changed and but the price of gold has skyrocketed and is getting close to 3 times the value of platinum. This coin is in untouched condition and of proof quality, still in its protective plastic packaging. The coin weighs 9.3 grams (0.299 troy ounces). It comes in its original packaging with certificate. This commemorative coin would make a great gift the the coin collector or bullion collector. It can be purchased sales tax exempt for its metal content value plus 10%. Stock #912-00647.

The coin weighs 9.3 grams (0.299 troy ounces). It comes in its original packaging with certificate. This commemorative coin would make a great gift the the coin collector or bullion collector. It can be purchased sales tax exempt for its metal content value plus 10%. Stock #912-00647.

SOLD

October 16, 2024

1 kilogram (32.15 troy ounces) 999 fine silver Pamp Suisse. Spot + 5%. 912-00639

I’m pretty sure there are potentially better investments than purchasing a kilogram of silver bullion, but I’m 100% positive there are many worse places to spend a little rainy day money. I’m also sure that buying this silver bar at just 5% above the actual silver price is a value few vendors will match. I can point out a few interesting facts about the cost of silver right now. If you’re reading this you likely know gold is flirting with an all time high in both Canadian and U.S. dollars, but silver is still needs to appreciate close to 20% to match its all time high that was reached way back in 1980. Right now gold costs around 84 times what silver does; historically speaking over the last 100 years or so that ratio has been closer to 40 times. Unless you feel gold is overpriced right know, silver is very undervalued. This bar can be purchased without additional sales tax. It is available for the actual silver value plus just 5%. Stock #912-00639.

I’m pretty sure there are potentially better investments than purchasing a kilogram of silver bullion, but I’m 100% positive there are many worse places to spend a little rainy day money. I’m also sure that buying this silver bar at just 5% above the actual silver price is a value few vendors will match. I can point out a few interesting facts about the cost of silver right now. If you’re reading this you likely know gold is flirting with an all time high in both Canadian and U.S. dollars, but silver is still needs to appreciate close to 20% to match its all time high that was reached way back in 1980. Right now gold costs around 84 times what silver does; historically speaking over the last 100 years or so that ratio has been closer to 40 times. Unless you feel gold is overpriced right know, silver is very undervalued. This bar can be purchased without additional sales tax. It is available for the actual silver value plus just 5%. Stock #912-00639.

SOLD

September 29, 2024

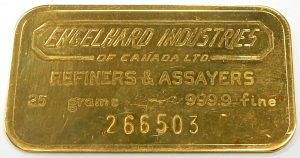

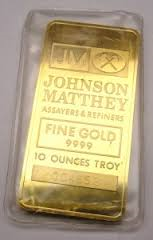

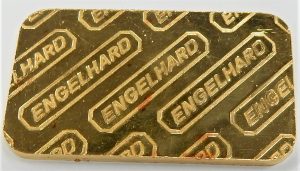

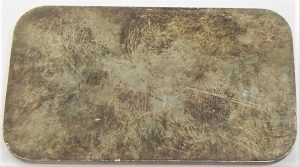

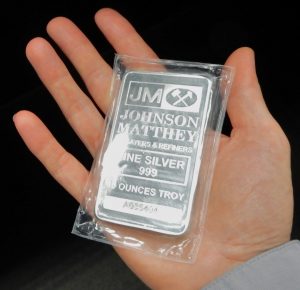

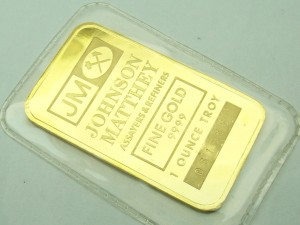

1 & 5oz. Johnson Matthey, Engelhard, fine silver bars. Spot plus 10%. 912-00619 through 912-00626

Get into the silver bullion market and get into the collectible market all at the same time with these uncommon Johnson Matthey and Engelhard 999 fine silver 1 and 5 ounce bars. These hold more than just bullion value as both of these companies are no longer in business. Examples of their bullion products are getting harder to find as collectors are squirrelling them away. Some of these are smooth backs with one example of a private label. Often you can’t buy contemporary silver bullion with a low 10% premium over the spot price. We’re offering any one or all of these for simply their intrinsic value plus 10%. They are not subject to any form of sales tax. For the current price of silver and gold in Canadian dollars, click here. We don’t expect these to last more than a day. They will likely all be sold at the same time to the first collector who sees them. First come, first serve. For credit card purchased please at 2%. Stock #912-0019 through 912-00026.

Get into the silver bullion market and get into the collectible market all at the same time with these uncommon Johnson Matthey and Engelhard 999 fine silver 1 and 5 ounce bars. These hold more than just bullion value as both of these companies are no longer in business. Examples of their bullion products are getting harder to find as collectors are squirrelling them away. Some of these are smooth backs with one example of a private label. Often you can’t buy contemporary silver bullion with a low 10% premium over the spot price. We’re offering any one or all of these for simply their intrinsic value plus 10%. They are not subject to any form of sales tax. For the current price of silver and gold in Canadian dollars, click here. We don’t expect these to last more than a day. They will likely all be sold at the same time to the first collector who sees them. First come, first serve. For credit card purchased please at 2%. Stock #912-0019 through 912-00026.

SOLD

September 18, 2024

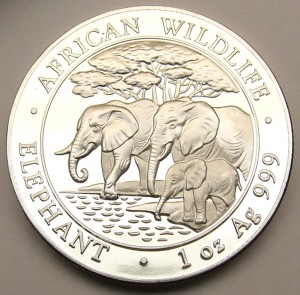

19 x 1oz. 999 fine silver round medallions. Spot plus 5%. 912-00628

Buy them now and do your research later. No one is selling fine silver bullion at just spot plus 5%. Fine bullion like this is sales tax exempt. Buying these is an excellent way to get into precious metal investing. This is a great variety from recognized producers from around the world. This collection of 19 x 1 ounce round medallions consists of a South African Krugerrand, CIBC 150th. anniversary, Britannia, Austria Philharmonic, Armenian Noah’s Ark, and Asahi Japan medallions. As we post these September 17th, 2024 the spot price of silver closed are $41.74 per ounce Canadian, bringing the cost of these to $832.71 CAD (including 5% premium). We don’t expect them to last. If you are interested in acquiring some inexpensive silver bullion, contact us immediately. These are being sold as a package of 19 only. For credit card purchases please add 2%. Stock #912-00628.

Buy them now and do your research later. No one is selling fine silver bullion at just spot plus 5%. Fine bullion like this is sales tax exempt. Buying these is an excellent way to get into precious metal investing. This is a great variety from recognized producers from around the world. This collection of 19 x 1 ounce round medallions consists of a South African Krugerrand, CIBC 150th. anniversary, Britannia, Austria Philharmonic, Armenian Noah’s Ark, and Asahi Japan medallions. As we post these September 17th, 2024 the spot price of silver closed are $41.74 per ounce Canadian, bringing the cost of these to $832.71 CAD (including 5% premium). We don’t expect them to last. If you are interested in acquiring some inexpensive silver bullion, contact us immediately. These are being sold as a package of 19 only. For credit card purchases please add 2%. Stock #912-00628.

SOLD

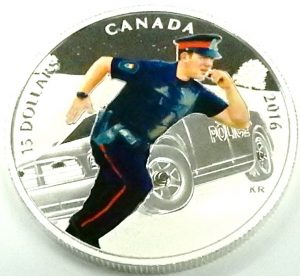

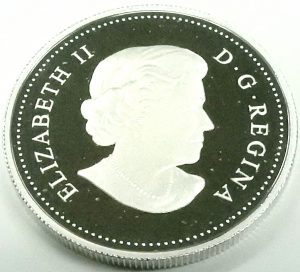

25 fine silver 2016 Canadian Maple Leaf $5.00 coins. Spot + 10%!!! NO SALES TAX. 912-00632

Need a gift for the hard to buy for? I bet they don’t have any of these. We seldom sell fine silver, but sometimes it begins to pile up and we need to free up space. We’ve been buying it for years but rarely do we sell it, especially when silver seems so inexpensive compared to gold. Right now silver is 86 times less expensive than gold. This tube of 25 x 1 ounce 9999 fine silver maple leaf coins are all dated 2106 and are in very good condition.

Need a gift for the hard to buy for? I bet they don’t have any of these. We seldom sell fine silver, but sometimes it begins to pile up and we need to free up space. We’ve been buying it for years but rarely do we sell it, especially when silver seems so inexpensive compared to gold. Right now silver is 86 times less expensive than gold. This tube of 25 x 1 ounce 9999 fine silver maple leaf coins are all dated 2106 and are in very good condition. If you don’t own any silver now’s your chance to get into the bullion market with these. They are being sold for the silver spot price plus just 10% and no HST. The price changes every minute. For up to the second price in Canadian dollars for silver and gold click here. First come first serve. If you want them email us at info@BillLeBoeufJewellers.com give us a call at 705 728 3343 or come in ASAP. The major bullion retailers sell these coins for usually 15% over the spot price. These are likely the best value currently on the market. Sold by the tube of 25 only for just spot silver price plus 10%. There is no sales tax on the purchase of gold or silver bullion. Credit card purchase please add 2%. Stock #912-00632.

If you don’t own any silver now’s your chance to get into the bullion market with these. They are being sold for the silver spot price plus just 10% and no HST. The price changes every minute. For up to the second price in Canadian dollars for silver and gold click here. First come first serve. If you want them email us at info@BillLeBoeufJewellers.com give us a call at 705 728 3343 or come in ASAP. The major bullion retailers sell these coins for usually 15% over the spot price. These are likely the best value currently on the market. Sold by the tube of 25 only for just spot silver price plus 10%. There is no sales tax on the purchase of gold or silver bullion. Credit card purchase please add 2%. Stock #912-00632.

SOLD

July 22, 2024

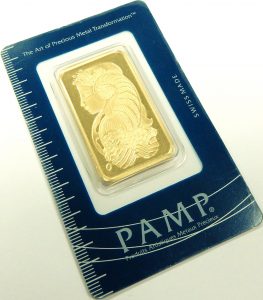

1 ounce 999.9 fine gold PAMP Suisse Lady Fortuna. Spot+3% (14kt. frame $250.00 extra). 912-00610 436-00318

In the 45 years since Pamp Suisse has been around they have grown from a small supplier of precious metals to jewellers and watch manufactures, to producing private market bullion, and suppling several international governments with currency backed bullion coins. Private investment PAMP (Produits Artistiques Métaux Précieux) Suisse bullion is recognized world wide and is among the most sought after. While not quite as common as Royal Canadian Mint products around here, it isn’t rare for us to have some Pamp Suisse bullion in stock. This 1 ounce bar is not only bullion, but it is jewellery if you buy the 14 karat yellow gold frame. Jewellery can certainly be a small part of an investment portfolio when efficiently purchased. This early Pamp bar depicts Lady Fortuna on the reverse side on the bar. From the Pamp’s website; “PAMP was the first precious metals brand to ever decorate the reverse sides of its minted bars. Introduced in 1979, the Lady Fortuna™ was the first of those artistic motifs and is today world-renowned as a trusted symbol assuring PAMP quality and authenticity. Undoubtedly, the iconic Lady Fortuna™ image is the most recognized and prestigious bullion bar design in the world. The Roman goddess of prosperity is portrayed with all of her mythical attributes: sheaves of wheat, poppies, horn of plenty, precious coins, and wheel of fortune.” The 1 ounce bar is secured in a 14 karat yellow gold frame. The frame design secures the bar without gold solder or potential damage caused by tabs and claws. It is held in place with a threaded screw that tightens the coin-edge bezel. The frame weighs 2.7 grams and is priced separately at $250.00. This is not a new item but remains in unpolished condition. There are signs of use in the form of small impact marks on the polished and matt finishes. The connecting ring and bail show no signs of wear and tear.

In the 45 years since Pamp Suisse has been around they have grown from a small supplier of precious metals to jewellers and watch manufactures, to producing private market bullion, and suppling several international governments with currency backed bullion coins. Private investment PAMP (Produits Artistiques Métaux Précieux) Suisse bullion is recognized world wide and is among the most sought after. While not quite as common as Royal Canadian Mint products around here, it isn’t rare for us to have some Pamp Suisse bullion in stock. This 1 ounce bar is not only bullion, but it is jewellery if you buy the 14 karat yellow gold frame. Jewellery can certainly be a small part of an investment portfolio when efficiently purchased. This early Pamp bar depicts Lady Fortuna on the reverse side on the bar. From the Pamp’s website; “PAMP was the first precious metals brand to ever decorate the reverse sides of its minted bars. Introduced in 1979, the Lady Fortuna™ was the first of those artistic motifs and is today world-renowned as a trusted symbol assuring PAMP quality and authenticity. Undoubtedly, the iconic Lady Fortuna™ image is the most recognized and prestigious bullion bar design in the world. The Roman goddess of prosperity is portrayed with all of her mythical attributes: sheaves of wheat, poppies, horn of plenty, precious coins, and wheel of fortune.” The 1 ounce bar is secured in a 14 karat yellow gold frame. The frame design secures the bar without gold solder or potential damage caused by tabs and claws. It is held in place with a threaded screw that tightens the coin-edge bezel. The frame weighs 2.7 grams and is priced separately at $250.00. This is not a new item but remains in unpolished condition. There are signs of use in the form of small impact marks on the polished and matt finishes. The connecting ring and bail show no signs of wear and tear. In refined form such as this 999.9 gold bar, precious metal is not subject to any form of sales tax. The cost of this bar fluctuates with the price of gold. We are selling this bar for only its intrinsic value plus 3%. The current value of gold changes every minute and can be seen in Canadian dollars here. If you are planning to purchase with a credit card, please add 2% to cover the extra costs associated with accepting VISA or MasterCard (we do not accept American Express). The 14 karat gold frame is estate priced at $250.00 CAD. Stock #436-00318. Pamp Suisse 1 ounce Lady Fortuna 999.9 gold bar, priced at spot plus 3% (no sales tax). Stock #912-00610.

In refined form such as this 999.9 gold bar, precious metal is not subject to any form of sales tax. The cost of this bar fluctuates with the price of gold. We are selling this bar for only its intrinsic value plus 3%. The current value of gold changes every minute and can be seen in Canadian dollars here. If you are planning to purchase with a credit card, please add 2% to cover the extra costs associated with accepting VISA or MasterCard (we do not accept American Express). The 14 karat gold frame is estate priced at $250.00 CAD. Stock #436-00318. Pamp Suisse 1 ounce Lady Fortuna 999.9 gold bar, priced at spot plus 3% (no sales tax). Stock #912-00610.

SOLD

July 5, 2024

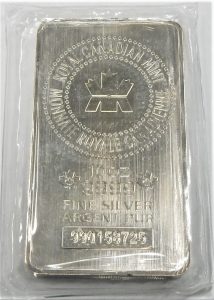

100oz. Royal Canadian Mint 9999 fine silver bars $4,675.00 CAD (no tax). 912-00483

Silver bullion is so cheap right now. 1 ounce of silver is around 77 times less expensive than 1 ounce of gold. The historic relationship of gold vs. silver price is more like 40 to 1 and gold is only around 17 times more rare than silver. There have only been a few times in history that I’m aware of when the gold/silver ratio has been higher. This tells us that gold is overpriced or that silver is underpriced. With all the chaos in the world my personal opinion is both silver and gold are under valued but much more so in the case of silver. With silver pricing as low as it has been for the last few years we’ve slowly been acquiring silver but seldom (almost never) do we sell any of it. For all those people who call us asking for silver bullion here’s your chance. These two 100 ounce bars of 999 fine silver were made by The Royal Canadian Mint. The bars measure just 18.4cm x 8.1cm x 2.1cm but are surprisingly hefty when you hold them in you hand.

Silver bullion is so cheap right now. 1 ounce of silver is around 77 times less expensive than 1 ounce of gold. The historic relationship of gold vs. silver price is more like 40 to 1 and gold is only around 17 times more rare than silver. There have only been a few times in history that I’m aware of when the gold/silver ratio has been higher. This tells us that gold is overpriced or that silver is underpriced. With all the chaos in the world my personal opinion is both silver and gold are under valued but much more so in the case of silver. With silver pricing as low as it has been for the last few years we’ve slowly been acquiring silver but seldom (almost never) do we sell any of it. For all those people who call us asking for silver bullion here’s your chance. These two 100 ounce bars of 999 fine silver were made by The Royal Canadian Mint. The bars measure just 18.4cm x 8.1cm x 2.1cm but are surprisingly hefty when you hold them in you hand. They each weigh just a little under 7 pounds. RCM bars are about the most sought after brand in the business. The Royal Canadian Mint’s products are universally acknowledged as among the most pure in the world. Many fine silver bars are 99.9% pure; these RCM bars are 99.99% fine silver. We usually squirrel away these but at the moment they are taking up too much room. Who knows the next time we’ll sell off some of our silver hoard (don’t hold your breath). There is no HST on the sale of precious metals as Revenue Canada looks upon these sales as financial transactions therefore not subject to the HST. Everyone should own some bullion as security against the effects inflation has on your cash. This is one of the few 100 ounce bars we are selling at the moment. Estate priced at just $4,675.00 CAD (credit card purchases please add 2% service fee). First come first serve. Contact us immediately if you’re interested. Stock #912-00483.